IL CCAP_IV 2006-2026 free printable template

Show details

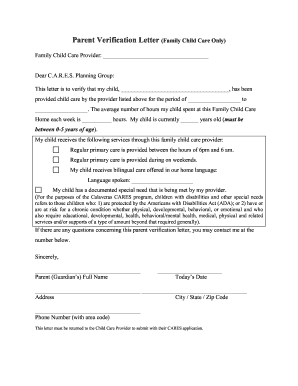

CCAPIV. doc rev. 8/10/2006 INCOME VERIFICATION 1340 S Damen Avenue 3rd Floor CHICAGO IL 60608 phone 312 823-1100 fax 312 823-1200 Attention Client This form must be signed by your employer before submitting to our office. TO BE FILLED OUT BY CLIENT Client s Name Case Number Employee s Name I authorize my employer to release the following information to Illinois Action for Children. I understand this form is for initial eligibility purposes and that I will be asked to submit additional proof...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign illinois income verification form

Edit your wage verification form illinois form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois income verification questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self employment income verification form illinois online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 266 verification of employment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out il form income verification

How to fill out IL CCAP_IV

01

Gather all necessary information including personal identification, income details, and dependent information.

02

Start by entering your name and contact information at the top of the form.

03

Provide details about your household, including the names and dates of birth of all family members.

04

Fill in your income details such as wages, benefits, and any additional sources of income.

05

Complete the sections requiring information about your childcare expenses.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs IL CCAP_IV?

01

Parents or guardians who are seeking financial assistance for childcare costs.

02

Individuals applying for assistance through the Illinois Child Care Assistance Program.

Fill

income verification form

: Try Risk Free

People Also Ask about wage verification form action for children

What is the current Illinois withholding form?

You must submit Form IL-W-4 when Illinois Income Tax is required to be withheld from compensation that you receive as an employee. You may file a new Form IL-W-4 any time your withholding allowances increase. If the number of your claimed allowances decreases, you must file a new Form IL-W-4 within 10 days.

Are you exempt from Illinois income tax withholding?

For tax years beginning January 1, 2022, it is $2,425 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,425 or less, your exemption allowance is $2,425. If income is greater than $2,425, your exemption allowance is 0. For the 2021 tax year, it is $2,375 per exemption.

What is IL W 5 form?

To employers: You are required to have a copy of this form on file for each employee who. • is a resident of Iowa, Kentucky, Michigan, or Wisconsin; receives com- pensation paid in Illinois; and elects to claim exemption from withhold-

Who is subject to il withholding tax?

Generally, you must withhold Illinois Income Tax for your Illinois employee if: you withhold federal income tax, or. you and your employee enter into a voluntary withholding agreement. (We do not require a separate agreement for payments covered by a federal voluntary withholding agreement.)

What is an IL form?

IL-1040 Individual Income Tax Return.

What is Illinois form ST 556 for?

If you sell items at retail in Illinois that are of the type that must be titled or registered by an agency of Illinois state government (e.g., vehicles, watercraft, aircraft, trailers, manufactured (mobile) homes), you must report these sales on Form ST‑556, Sales Tax Transaction Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find action for children income verification?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the action for children wage verification form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the ccap wage verification form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form 266 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit ccap iv verification on an Android device?

You can edit, sign, and distribute income verification form pdf on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IL CCAP_IV?

IL CCAP_IV is a form used in Illinois for reporting various types of income and expenditures as part of the Child Care Assistance Program.

Who is required to file IL CCAP_IV?

Individuals or families that receive child care assistance from the Illinois Department of Human Services are required to file IL CCAP_IV.

How to fill out IL CCAP_IV?

To fill out IL CCAP_IV, individuals must provide personal information, details about the child care service providers, income information, and any relevant expenses. It is important to follow the instructions provided with the form carefully.

What is the purpose of IL CCAP_IV?

The purpose of IL CCAP_IV is to help track and verify the income and expenditures related to child care assistance, ensuring that families receive the appropriate level of support.

What information must be reported on IL CCAP_IV?

IL CCAP_IV requires reporting on household income, child care provider details, specific expenses related to child care, and any changes in family circumstances that may affect eligibility.

Fill out your IL CCAP_IV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medicaid Employment Verification Form is not the form you're looking for?Search for another form here.

Keywords relevant to illinois ccap application

Related to form 266 266a

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.